🏡 First-Time Home Buyer Loans in Oregon, Washington & Idaho

Smart strategies to buy your first home in 2025 — even with rising prices

Buying your first home is a big step — and the current market might feel intimidating. But here’s the truth: if your budget works and you’re ready to put down roots, there are still great loan programs designed just for you.

I’m Matt Jolivette, a mortgage broker based in the Portland metro area. I’ve helped hundreds of first-time buyers across Oregon, Washington, and Idaho get into homes with as little as 3% down — sometimes even zero.

Let’s walk through what you actually need to know (no fluff, no sales pitch).

🎯 Who Qualifies as a First-Time Home Buyer?

If you haven’t owned a home in the past three years, you’re considered a first-time buyer. That opens the door to special loan programs with:

-

Lower down payment requirements

-

More flexible credit options

-

Down payment and closing cost assistance

Yes — even if you’ve owned before, you may qualify again.

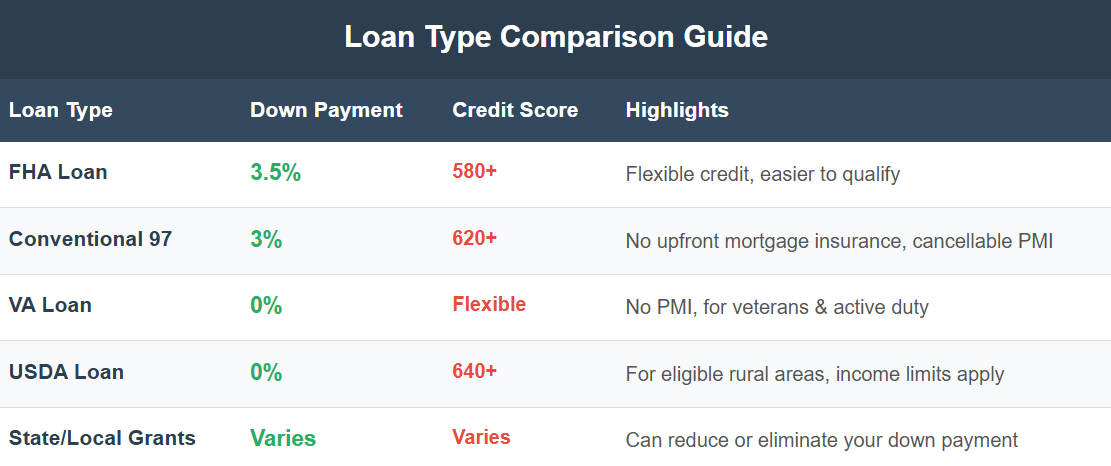

🔍 First-Time Buyer Loan Options (2025)

I’ll help you compare all of these based on your situation and location.

📈 Local Market Reality Check (2025)

Here’s what first-time buyers are facing in the markets I serve:

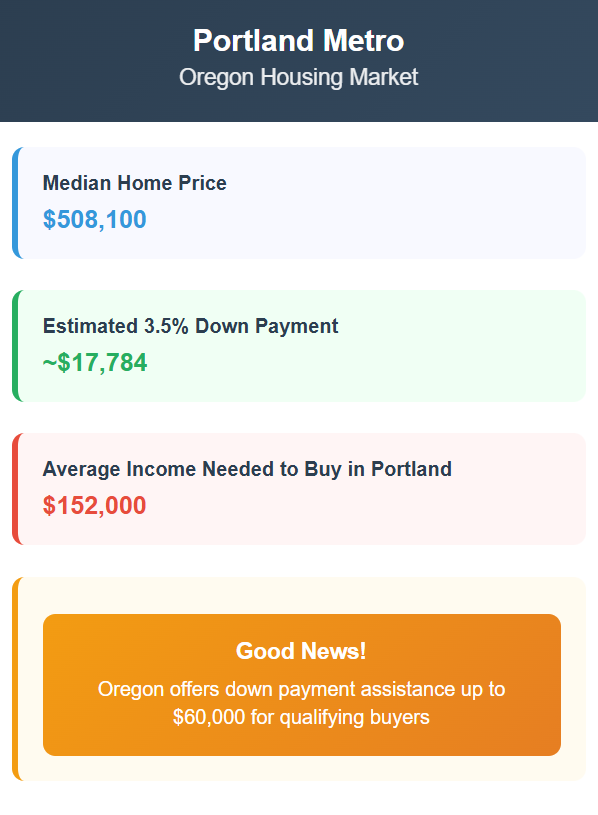

Portland Metro / Oregon

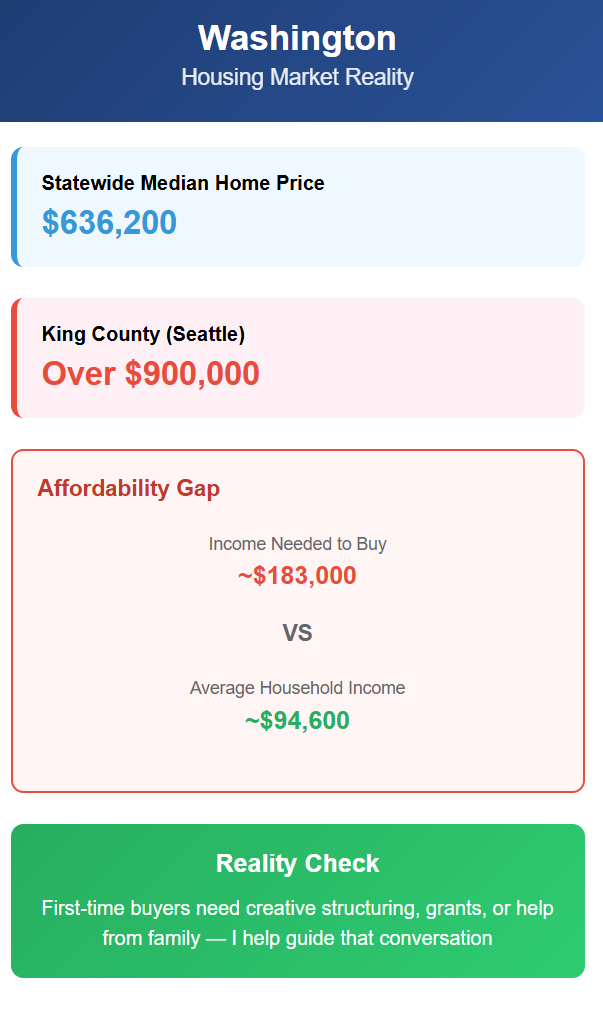

Washington

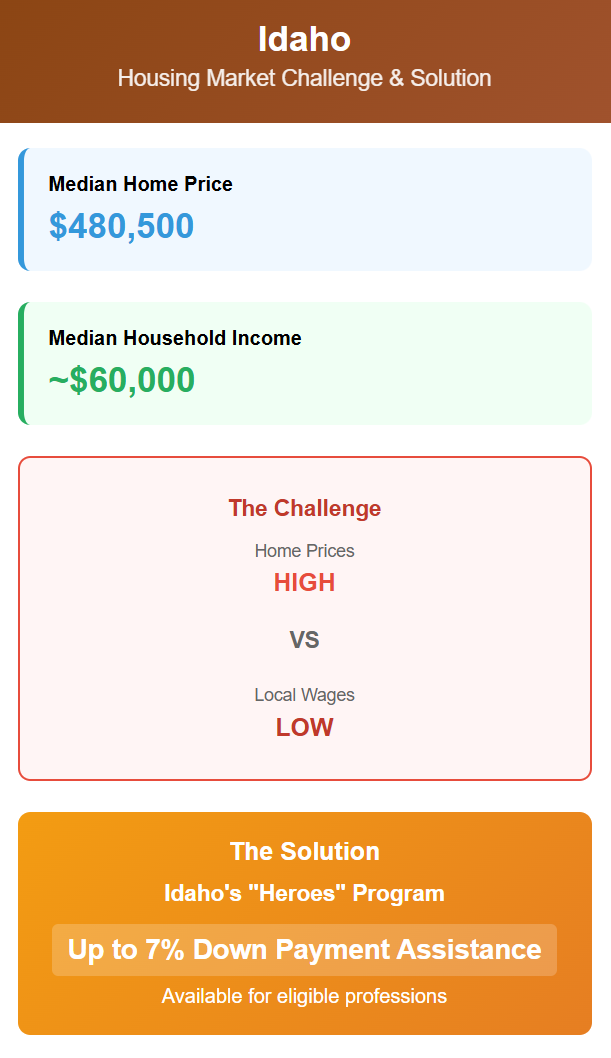

Idaho

💡 What You Actually Need to Buy

Forget the myths — here’s what you really need:

-

✅ A 3% to 3.5% down payment (on most programs)

-

✅ A credit score of 580 or higher (FHA is most flexible)

-

✅ A 2-year job or income history (doesn’t have to be at the same job)

-

✅ Realistic expectations — and someone who explains the full picture

🧠 Real Talk: Is Now a Good Time to Buy?

Prices are still high. Rates are still bouncing around. But here’s the key: if the payment fits your budget, that’s a green light.

Don’t wait for some mythical crash or 3% rate — those aren’t coming back soon. You can always refinance later if rates drop, but buying today locks in your housing cost and starts building equity.

💬 I’ve had clients buy at 6.75%, then refi 18 months later to 5.5% — and they were glad they didn’t wait.

🤝 What I Do for You

As a mortgage broker, I:

-

Shop multiple lenders to find the best loan for you

-

Help you understand all the real costs upfront (no games)

-

Make sure you’re pre-approved and ready to compete

-

Work closely with your real estate agent so your offer stands out

I’m local, independent, and always available to answer questions — not some call center with a script.

📞 Let’s Get You Started

Whether you’re buying in Portland, Boise, Vancouver, Spokane, Eugene, or anywhere else in the Northwest — I can help.

Associated Mortgage Brokers is not affiliated with or acting on behalf of any government agency.