As we turn the page on 2025, the housing market in the Pacific Northwest is…

The Portland-Hillsboro-Vancouver Housing Market Is Turning a Corner Going Into 2026

The Portland-Hillsboro-Vancouver Housing Market Is Turning a Corner Going Into 2026

After several years of high mortgage rates and hesitation from buyers, momentum is quietly building beneath the surface of the Portland-Hillsboro-Vancouver MSA. Sellers in places like Hillsboro, Beaverton, Vancouver, and Camas are re-entering the market. Buyers across Multnomah, Washington, and Clark County are beginning to re-engage. And for the first time in what feels like years, we’re seeing consistent movement again.

It’s not a surge — but it is a meaningful shift. One that could help set the stage for a stronger 2026 throughout the metro.

Below are the three major dynamics driving the comeback, along with localized neighborhood-level insights showing how these trends are playing out across the region.

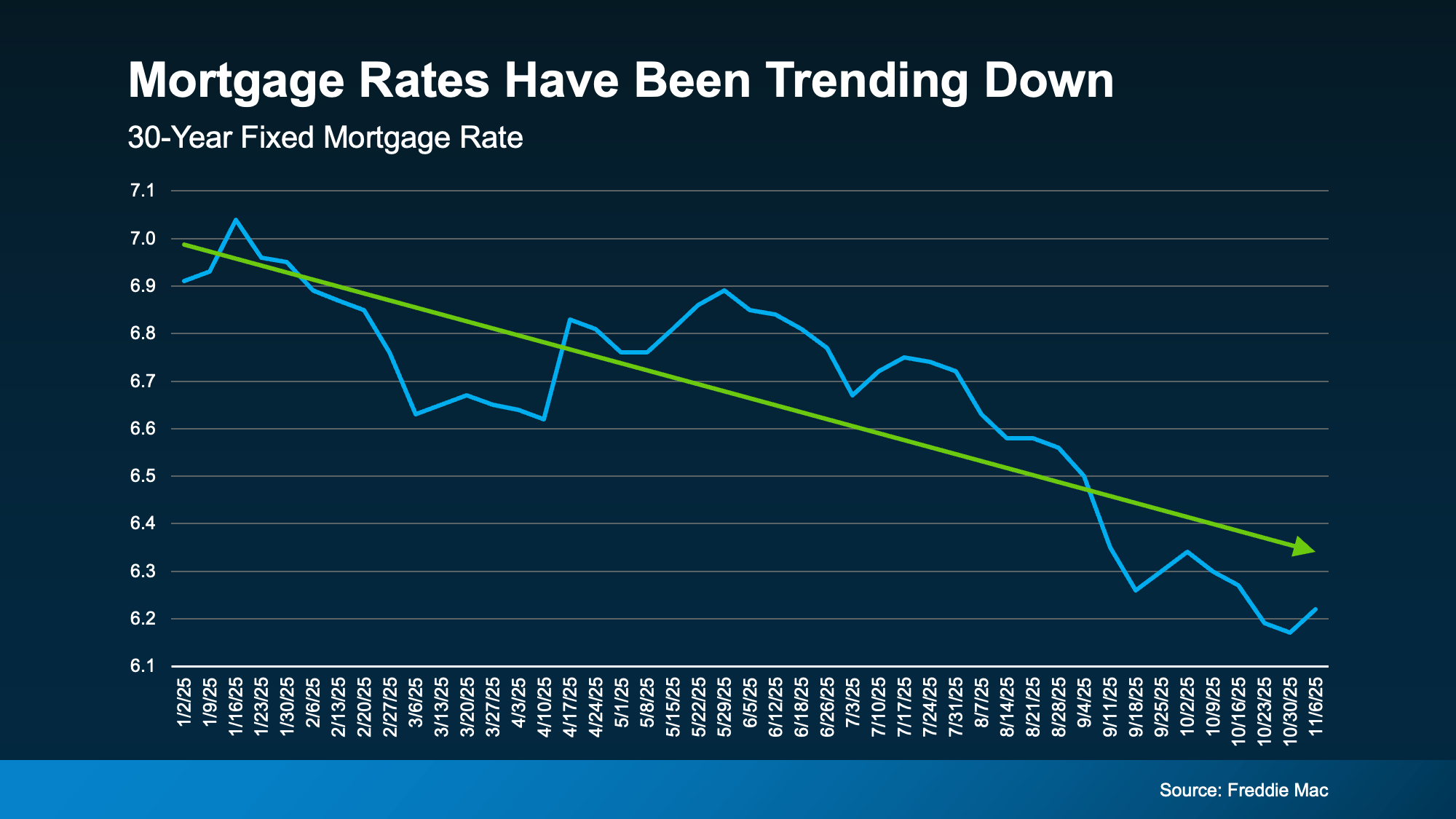

1. Mortgage Rates Have Been Coming Down — And It’s Shifting Buying Power Across the Metro

Rates remain volatile, but the larger trend matters more: they’ve been easing. Even a small dip has a big effect on affordability in our region, especially in areas where home prices run above the national average.

Where lower rates matter most locally:

-

Hillsboro & Beaverton: Buyers competing near tech corridors (Orenco Station, Five Oaks, Cedar Hills) are seeing noticeably stronger purchasing power. Pre-approvals stretch farther than they did last year.

-

Southwest Portland (Multnomah Village, Hillsdale): Lower rates help soften the jump into jumbo territory, which is common in larger Southwest homes.

-

Vancouver & East Vancouver: Many Oregon buyers moving north for property tax relief are finding their pre-approvals go further than expected when combined with slightly lower rates.

-

Gresham & Troutdale: Rate-sensitive first-time buyers are returning, especially those leveraging FHA or Oregon Bond-style loan products.

Overall, more buyers can afford to re-enter the market — and we’re seeing that shift show up in week-to-week showing activity around the metro.

2. More Homeowners Are Preparing to Sell — Unlocking Inventory Across the Region

The “rate-lock effect” hit Portland harder than many metros, especially in established neighborhoods with many long-time owners. But that’s easing.

Life changes — job relocations, upsizing, downsizing, and the need for more space — are beginning to outweigh the desire to hang onto ultra-low pandemic-era rates.

How this looks neighborhood by neighborhood:

-

Beaverton & Hillsboro: Move-up sellers are returning. Well-maintained homes near MAX lines or tech employers are hitting the market more consistently.

-

Northeast Portland (Alameda, Beaumont, Roseway): Classic Craftsman and mid-century homes are coming on the market again after years of scarcity.

-

Southeast Portland (Mt. Tabor, Sellwood, Woodstock): Inventory has ticked up, giving buyers choices they haven’t had since before 2020.

-

Vancouver, Camas & Washougal: Newer construction and desirable school districts are motivating sellers who were waiting for the right timing. Camas homes rarely linger if priced right.

-

Gresham & Troutdale: A meaningful increase in listings has opened the door for more budget-conscious buyers.

More inventory across these key neighborhoods means buyers have more options — and sellers can list without worrying that they won’t find their next home.

3. Buyers Are Re-Entering the Market — With Neighborhood Preferences Shifting

As affordability improves and inventory expands, demand in the Portland-Vancouver metro is returning — not explosively, but steadily.

Where we’re seeing the strongest return of buyers:

-

East Vancouver & Felida: These communities continue to attract both Washington and Oregon buyers looking for newer homes, more space, and tax advantages.

-

Camas: High-performing schools and modern subdivisions keep this one of the hottest pockets in the region.

-

Beaverton & Hillsboro: Tech aftershocks are still driving relocation demand, and buyers are again competing for well-located homes near major employers.

-

NE Portland (Concordia, Alameda, Alberta Arts): Strong demand is returning for walkable neighborhoods with character homes.

-

SE Portland (Sellwood, Moreland, Woodstock): Younger buyers are jumping back in as rates tick down, with many pairing conventional loans with renovation financing.

-

Gresham & Troutdale: Often the first places where rate-sensitive FHA and first-time buyers reappear — and that’s happening again.

Buyer activity isn’t uniform — but across the metro, interest is clearly picking up.

Bottom Line for Portland-Hillsboro-Vancouver

After several slower-than-normal years, the regional housing market is finally starting to turn a corner:

-

Mortgage rates are easing.

-

Inventory is improving across nearly every major neighborhood.

-

Buyers are coming back into the market — especially in the suburbs and Clark County.

If you live in — or are looking to move to — Beaverton, Hillsboro, Southwest Portland, Northeast Portland, Vancouver, Camas, Gresham or Troutdale, 2026 is shaping up to offer more opportunity than the past several years.