If you’re thinking about buying a home, you should know your credit score’s a critical…

What Credit Score Do You Really Need to Buy a Home in Portland–Vancouver?

What Credit Score Do You Really Need to Buy a Home in Portland–Vancouver?

If you’re planning to buy a home in the Portland–Vancouver area, your credit score will play a key role—but it might not need to be as high as you think.

Many local buyers believe they need a perfect score to qualify, but the reality is more flexible. The exact number depends on your loan type and other financial factors.

There’s No One “Magic Number”

While higher credit scores can unlock better rates and terms, many homebuyers are approved with scores in the 600–640 range, especially when they have steady income, manageable debt, and some savings.

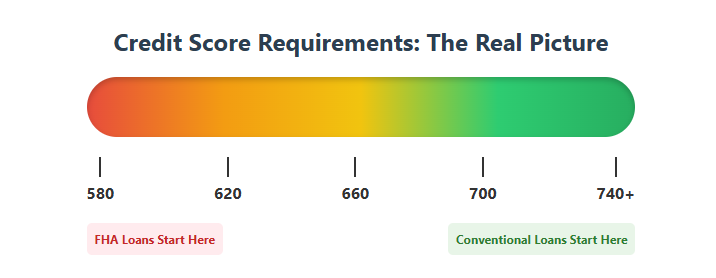

Common Loan Types and Minimum Credit Scores

Here’s a quick look at the typical credit score ranges for popular home loan options in the Portland–Vancouver market:

| Loan Type | Typical Minimum Score | Down Payment | Notes |

|---|---|---|---|

| Conventional | ~620+ | 3–5% | PMI required if <20% down |

| FHA | 580 (or ~500 with 10%+) | 3.5%–10% | More lenient on credit, higher mortgage insurance |

| VA | ~620 (varies by lender) | 0% | For eligible veterans, no PMI |

| USDA | ~620+ | 0% | Income and location limits apply |

These figures reflect typical starting points, but actual requirements can vary by lender and borrower profile.

Why Your Credit Score Still Matters

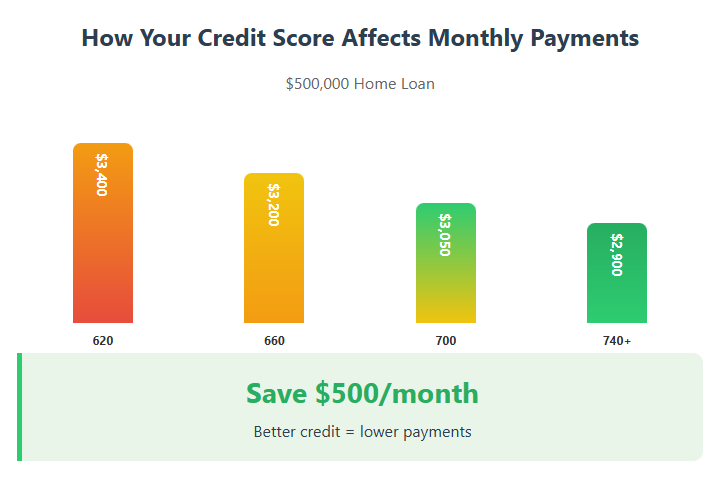

Even though you don’t need a perfect score to qualify, your credit rating still affects:

-

Your interest rate (which impacts your monthly payment)

-

Loan terms (including whether you’ll need private mortgage insurance)

-

Which loan types you’re eligible for

A slightly higher credit score could save you thousands over the life of the loan, so improving your score is always worth considering—even if you’re already qualified.

4 Smart Ways to Boost Your Credit Before Buying

If you’re close to qualifying but want to improve your chances—or secure better terms—here are a few strategies to work on:

-

Pay your bills on time – On-time payments are the most important credit factor.

-

Lower your credit utilization – Aim to keep your balances under 30% of your credit limits.

-

Check your credit report for errors – Correcting mistakes can quickly improve your score.

-

Avoid opening new credit lines – New inquiries can temporarily lower your score.

Even small improvements can move you into a better range before you apply.

Portland–Vancouver Market Tip

Whether you’re looking in Alberta Arts, Beaverton, downtown Vancouver, or anywhere in between, competition and pricing vary widely across the metro area. Getting a clear handle on your credit early helps you move faster when the right opportunity comes up.

Bottom Line

You don’t need perfect credit to buy a home in Portland or Vancouver. Many buyers qualify with scores in the low 600s, depending on the loan type. The key is to understand where you stand, improve where you can, and work with a local expert who can match you with the right mortgage options.

If you’re thinking about making a move, I’d be happy to review your credit situation, explore your options, and help you prepare for a confident homebuying journey.