Portland Housing Market Shows Promising Signs for Buyers in Late 2025 The Portland-Vancouver-Hillsboro metro area…

Why “Help with Mortgage” Searches Are Surging in the Pacific Northwest – What This Means for Homeowners

Why “Help with Mortgage” Searches Are Surging in the Pacific Northwest – What This Means for Homeowners

The Bottom Line

Pacific Northwest homeowners are struggling. Searches for mortgage help have reached crisis levels not seen since 2008, and the data from Oregon, Washington, and Idaho backs up what we’re seeing on the ground. If you’re a homeowner in the PNW feeling the pinch, you’re not alone.

The Numbers Tell the Story – Pacific Northwest Edition

Here’s what’s actually happening in our region right now:

43% of new homeowners nationwide are struggling to make payments on time – and the Pacific Northwest is seeing even worse numbers due to higher home prices.

Mortgage rates hit 6.5% as of September 2025, but many PNW borrowers are seeing closer to 7% due to loan amounts and regional factors.

Serious mortgage delinquencies are climbing for the first time in years, and Oregon, Washington, and Idaho aren’t immune.

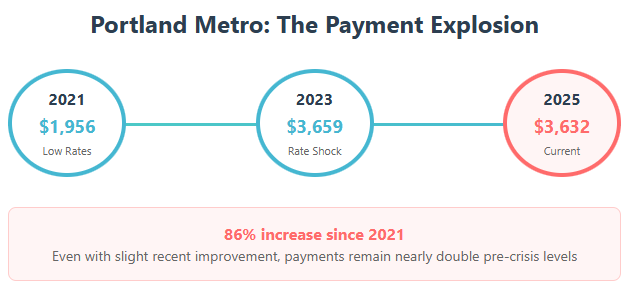

Portland Metro Reality Check

If you’re in the Portland-Vancouver-Hillsboro area, the numbers hit hardest:

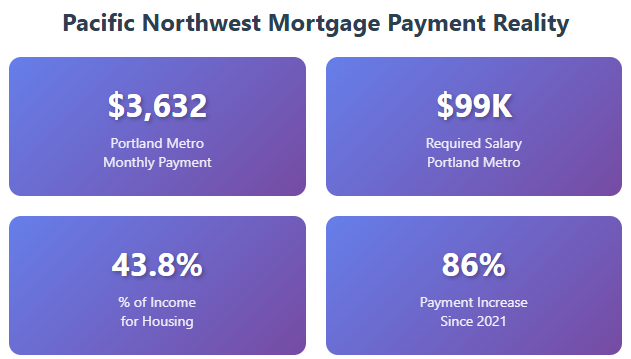

Average mortgage payment: $3,632/month – that’s what it costs to buy the typical home here in 2025.

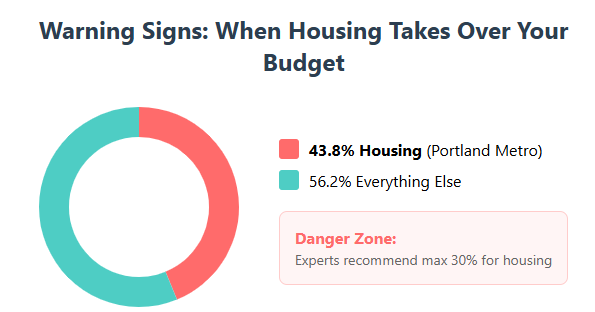

You need a $99K salary to afford that payment without being house-poor (payment takes about 44% of income).

Payments jumped 86% since 2021 when the average was just $1,956/month during the low-rate period.

We’re approaching bubble territory – mortgage payments as a percentage of income (43.8%) are getting close to the 2007 housing bubble levels (46.4%).

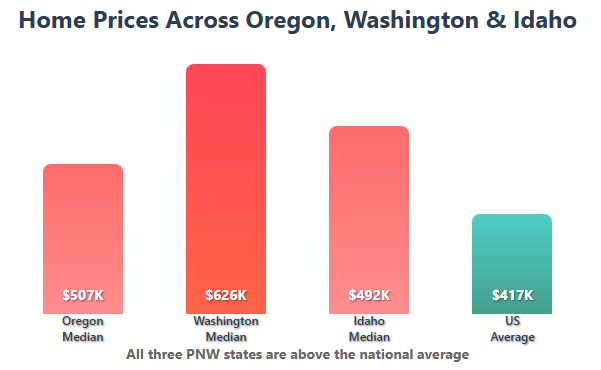

Oregon Statewide: The Bigger Picture

Beyond Portland metro, Oregon’s housing market shows concerning trends:

- Median home price: $506,800 statewide (up 4.7% year-over-year)

- Homes spend 62 days on market – giving buyers slightly more time but still competitive

- 28.7% of sellers are cutting prices – first sign of market pressure

- Cost of living is 15% higher than national average

Washington State: Even Pricier

Our neighbors to the north face even steeper challenges:

- Median home price: $626,100 (first quarter 2024)

- King County median: $931,000 – among the nation’s least affordable markets

- Home sales fell 21.5% year-over-year as buyers get priced out

- Only the highest earners can afford typical homes in most metro areas

Idaho: The “Affordable” Option That’s Not

Idaho attracted many PNW residents seeking affordability, but reality has set in:

- Median home price: $491,800 (up from the “cheap” reputation)

- Need $150K household income to afford half the homes on the market

- Boise area: $535,000 median – no longer the bargain it once was

- 2.9-month supply – still a severe shortage of inventory

Why This Is Happening in the Pacific Northwest

1. We Got Hit Harder by the Pandemic Boom

The PNW saw massive migration during COVID as remote workers fled expensive California markets. This drove up demand just as interest rates were at historic lows.

2. Supply Shortages Are Worse Here

- Oregon has about 3 months inventory (healthy is 5-6 months)

- Washington building permits down 6.4% year-over-year

- Idaho construction can’t keep up with population growth

3. The Rate Lock Effect is Severe

Over 80% of PNW homeowners have rates below 6%. Many have rates below 3%. Nobody wants to give up those payments to buy at 7%+ rates.

4. Cost of Living Pressure

Beyond housing, everything costs more in the PNW – from gas to groceries to utilities (except Idaho utilities, which are 18% below national average).

What Help Is Actually Available in Our States

Federal Programs Still Running

- Homeowner Assistance Fund (HAF): Oregon and Washington programs still active; Idaho has limited funds

- FHA and VA loans: Available in all three states with lower down payments

Oregon-Specific Help

- Oregon Housing FirstHome Program: 4-5% down payment assistance for qualified buyers

- Up to $60,000 in down payment help for eligible borrowers

- Portland Housing Center: Serves Portland metro with low-interest loans up to $80K

Washington Programs

- Washington State Housing Finance Commission: Various first-time buyer programs

- Regional variation: Programs vary significantly by county

Idaho Assistance

- Idaho Housing and Finance Association: Limited programs

- Lower property taxes: 0.67% average rate (14th lowest nationally)

What This Means for Homeowners

If You’re Struggling Right Now

- Call your lender immediately – don’t wait until you miss payments

- Oregon residents: Check if your county still has HAF funds available

- Washington residents: Contact your regional housing authority

- Idaho residents: Limited state programs, but federal options still available

If You’re Thinking of Buying

Portland Metro Buyers: Understand that $3,632/month is average. You’ll need $99K+ household income and should expect fierce competition.

Oregon Buyers: With 62 days average on market, you have more time to negotiate than in peak pandemic years.

Washington Buyers: Focus on counties outside King/Snohomish for better affordability.

Idaho Buyers: The “affordable Idaho” narrative is largely over. Budget like you’re buying in a major metro.

The Bigger Pacific Northwest Picture

This surge in “help with mortgage” searches reflects the end of the PNW housing dream for many middle-class families. When you need $99K just to afford an average Portland home, $150K for Idaho, and significantly more for most of Washington, we’ve priced out teachers, firefighters, and other essential workers.

Regional factors making it worse:

- Tech industry layoffs reducing high-end demand but not enough to help middle-class buyers

- Climate migration bringing more people to the “safer” PNW

- Supply chain issues keeping construction costs high

- Local regulations that slow new construction

The good news? Unlike 2008, we have:

- Strict lending standards (no more liar loans)

- High homeowner equity levels

- Strong local economies (despite tech layoffs)

- Lower foreclosure activity

The bad news? Relief will be slow. Most forecasts show:

- Rates staying above 6% through 2025

- Home prices continuing to rise, just more slowly

- Inventory remaining tight across all three states

What’s Next

The Pacific Northwest housing market is at a crossroads. We’re not facing a crash, but we are facing a crisis of affordability that’s fundamentally changing who can live here.

For homeowners struggling now, help is available but limited. For potential buyers, the math is harsh but understanding it helps set realistic expectations.

The surge in mortgage help searches tells us this isn’t just individual financial stress – it’s a regional housing system under pressure. Sometimes the system needs fixing, not just the people in it.

Need help with your mortgage situation? Licensed in Oregon, Washington, and Idaho, I can help you understand your options whether you’re struggling with payments or trying to buy in this challenging market. Don’t wait until you’re behind to explore what’s available.