Navigating FHA Loans in 2025: A Smart Guide for First-Time Buyers

If you’re buying your first home — or getting back into the market after a few years — you’ve probably heard of FHA loans. I’ve helped hundreds of buyers use them successfully, especially those who thought they “wouldn’t qualify.” FHA loans are a flexible option in 2025, and in some cases, they’ll even go higher on debt-to-income than conventional loans will allow.

Let’s walk through what you need to know.

✅ What Is an FHA Loan?

FHA loans are backed by the Federal Housing Administration and designed for buyers who might not have 20% down or perfect credit. They’re one of the best entry points into homeownership — especially in a high-priced or competitive market like the Northwest.

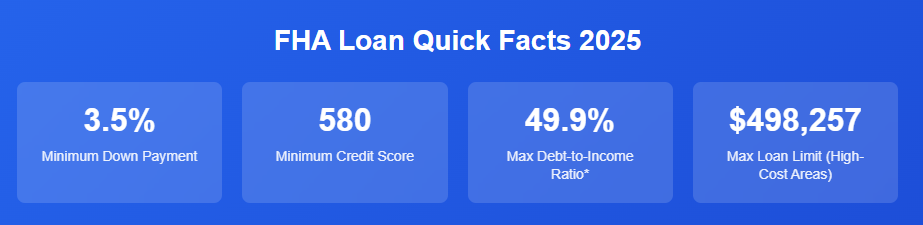

🔍 Quick FHA Facts (2025)

🧱 FHA Loan Benefits

-

Low Down Payment: 3.5% minimum

-

Flexible Credit Standards: 580+ score, or even 500 with 10% down

-

Easier Approval: More forgiving than conventional in many cases

-

Streamlined Refinances: FHA streamline is one of the easiest ways to lower your rate

-

Assumable Loans: Could be a huge advantage if you sell in a high-rate environment

⚠️ Things to Keep in Mind

-

Mortgage Insurance Is Required: Both upfront (1.75%) and monthly (0.55-.5%)

-

FHA Appraisal: The home must meet basic safety and condition standards

-

Loan Limits Vary: Based on county — I’ll help you look that up based on where you’re buying

🧠 Real Talk on DTI (Debt-to-Income)

This is one of the most misunderstood pieces. FHA generally caps DTI at 43%, but I’ve closed plenty of FHA deals with a DTI up to 49.9% — when the buyer had solid credit, stable income, or extra savings. If you’ve been told “your ratios are too high,” it might be worth a second look.

🏡 Is FHA a Fit for You?

You might be a great FHA candidate if:

-

You’re buying your first home (or haven’t owned in the last 3 years)

-

You have limited savings but decent income

-

Your credit is improving, but not quite “conventional ready”

-

You’re relocating or looking to refinance out of a high-interest mortgage

🔧 My Role in This

As a broker licensed in Oregon, Washington, and Idaho, I shop multiple lenders to match you with the best FHA loan for your situation. I don’t work for one bank — I work for you.

Whether we’re talking FHA, VA, conventional, or something unique — I’ll walk you through every option and help you close with confidence.

📞 Let’s Talk

Want a custom FHA scenario based on your credit, income, and down payment?