As we approach the final month of 2025, the Portland housing market is presenting a…

Mortgage Planning for the Year Ahead: A 2026 Roadmap from a Local Portland Mortgage Broker

As we turn the page on 2025, the housing market in the Pacific Northwest is signaling a shift. For many potential homebuyers and homeowners in Portland, Vancouver, and the broader Oregon/Washington region, the last few years have been defined by hesitation. High interest rates and economic uncertainty kept many on the sidelines. However, as we look toward 2026, the data suggests we are turning a corner.

I’m Matthew D. Jolivette, a Certified Mortgage Consultant® (CMC®) with over 25 years of experience serving the Pacific Northwest. If there is one thing I have learned navigating decades of market cycles, it is that preparation prevents panic. Success in the 2026 real estate market won’t happen by accident; it will happen through strategic mortgage planning.

Whether you are a first-time homebuyer in Beaverton, looking to upgrade in Hillsboro, or an investor eyeing multi-family units in Portland proper, this is your comprehensive roadmap for mortgage planning in the year ahead.

The 2026 Portland Housing Market Outlook

Before we dive into your personal financial roadmap, it is crucial to understand the terrain we are navigating. The Portland-Hillsboro-Vancouver housing market has shown resilience. While we aren’t expecting the frenzied appreciation of 2021, we are anticipating a normalization of rates and a steady increase in buyer activity.

Here is what we are monitoring for 2026:

- Rate Stabilization: Analysts project a more favorable interest rate environment compared to the peaks of previous years, increasing purchasing power for local buyers.

- Inventory Dynamics: Inventory remains tight in desirable neighborhoods across Multnomah and Washington Counties. This means well-prepared buyers with solid pre-approvals will win bidding

- Pent-Up Demand: Many buyers who waited out 2024 and 2025 are expected to enter the market in 2026, making early preparation essential.

Your Quarterly Mortgage Planning Roadmap

Buying a home is rarely an impulse decision—or at least, it shouldn’t be. To secure the best terms and the right home, I recommend a phased approach tailored to your timeline.

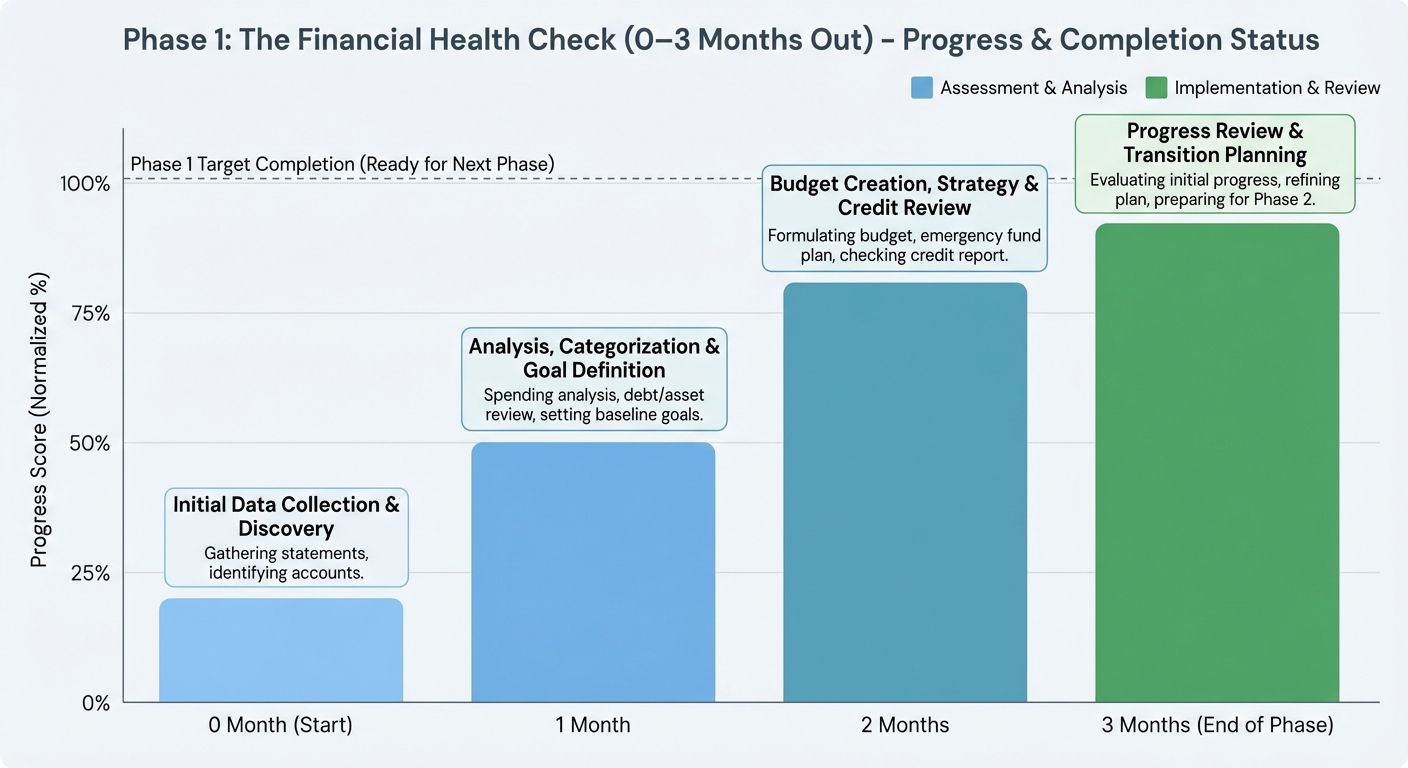

Phase 1: The Financial Health Check (0–3 Months Out)

- Credit Optimization: Do not just check your score; analyze the Are there errors? High utilization ratios? Now is the time to pay down revolving debt to boost your score into the “Excellent” (740+) tier for the best pricing.

- Asset Verification: Sourcing your down payment is critical. Whether it is savings, a gift from family, or proceeds from a sale, these funds need to be “seasoned” (sitting in your account) to ensure a smooth underwriting process later.

- Income Stability: If you are self-employed or a contract worker in the gig economy, we need to review your last two years of tax returns to calculate your qualifying income accurately.

Pro Tip: Do not open new credit cards or finance a new car during this phase. It can drastically alter your Debt-to-Income (DTI) ratio.

Phase 2: The Strategic Pre-Approval (3–6 Months Out)

There is a significant difference between a “pre-qualification” from a big box bank and a strategic pre-approval from a local expert. In a competitive Portland market, a pre-qualification letter is often not enough.

At Associated Mortgage Brokers, we dive deep. We verify your income, assets, and credit upfront. This allows us to issue a pre-approval that functions nearly as good as cash. When listing agents in Oregon see a pre-approval from a reputable local broker, they know the deal is likely to close.

Schedule a Zoom Strategy Session with me today to start this process. We will look at different loan scenarios so you know exactly what your monthly payment looks like at different price points.

Phase 3: House Hunting & Rate Watch (6+ Months Out)

We can discuss strategies like:

- Temporary Buydowns (2-1 Buydowns): Lowering your interest rate for the first two years of the loan to ease into your payments.

- Lock & Shop: Securing an interest rate while you continue to look for a home, protecting you if rates rise during your search.

Refinancing in 2026: Is It Time?

Mortgage planning isn’t just for homebuyers. If you purchased a home in 2023 or 2024 when rates were at their peak, 2026 might present a “refinance window.”

If rates drop significantly, a Rate and Term Refinance could save you hundreds per month. Alternatively, if you have built up significant equity as property values in the PNW have risen, a Cash-Out Refinance could help you consolidate high-interest debt or fund home renovations.

Comparing Loan Programs for Oregon Buyers

| Loan Program | Ideal For | Down Payment | Credit Score Req. |

| Conventional | Borrowers with strong | As low as 3% (First-time | Typically 620+ |

| FHA Loan | First-time buyers or those | 3.5% | Typically 580+ |

| VA Loan | Veterans and active | 0% | Flexible (often 620+) |

| Jumbo Loan | Luxury homes exceeding | 10-20% | Typically 700+ |

Note: Loan limits and requirements vary by county (e.g., Multnomah vs. Clark County). Contact me for the specific limits in your target area.

Why Partner with a Local Portland Mortgage Broker?

In an era of digital lenders and call centers, why work with a local expert? The answer is context and commitment.

I don’t work for a bank; I work for you. I understand the unique dynamics of the Oregon, Washington, and Idaho markets. I know which condo buildings in Portland are warrantable and which are not. I know how local property taxes impact your purchasing power in different counties. Most importantly, I hold the Certified Mortgage Consultant® (CMC®) designation, a certification held by less than 1% of mortgage brokers, demonstrating a commitment to the highest standards of education and ethics.

Frequently Asked Questions (FAQs)

1. When should I start the mortgage planning process for a 2026 purchase?

Ideally, you should start 3 to 6 months before you plan to buy. This gives us ample time to correct any credit errors, season your down payment funds, and determine exactly how much home you can afford without stretching your budget.

2. Are mortgage rates expected to drop in 2026?

While no one has a crystal ball, economic indicators suggest a stabilizing trend for mortgage rates going into 2026. However, waiting for the “perfect” rate can sometimes cost you more if home prices rise in the meantime. We can analyze the cost of waiting versus buying now during our strategy session.

3. What is the difference between a mortgage broker and a bank?

A bank can only offer you their specific loan products. As a mortgage broker, I act as a concierge, shopping your loan across multiple wholesale lenders to find the best rate and terms for your specific situation. This often results in lower rates and lower closing costs for my clients.

4. Do you offer assistance for first-time homebuyers in Oregon?

Absolutely. We work with various programs designed for first-time buyers, including

low-down-payment Conventional and FHA loans. We can also guide you on state-specific bond programs or down payment assistance grants if you qualify.

5. I am self-employed. Is it harder to get a mortgage?

It requires more documentation, but it is not necessarily “harder” if you work with a broker who understands self-employed income analysis. We review your tax returns, P&L statements, and can even look at bank statement loan programs if traditional tax returns do not reflect your true cash flow.

Let’s Build Your 2026 Mortgage Strategy

2026 is poised to be a year of opportunity for those who are prepared. Don’t navigate the complex world of interest rates, loan limits, and underwriting guidelines alone.

Whether you are looking to buy your first home, invest in real estate, or refinance your current mortgage, I am here to guide you every step of the way with clear, efficient, and tailored advice.