Have you been saving up to buy a home this year? If so, you know…

What the One Big Beautiful Bill Act Means for Homeowners in Oregon, Washington, and Idaho

What the OBBBA Means for Homeowners in Oregon, Washington, and Idaho

The recently passed One Big Beautiful Bill Act (OBBBA) is now law, and whether you love it or not, it brings big changes that matter for homeowners, buyers, and real estate professionals — especially here in the Portland metro area and across Oregon, Washington, and Idaho.

As a mortgage broker licensed in all three states, I wanted to break down what this means for you in simple terms.

🏠 Big Win for Real Estate

The OBBBA made several key tax benefits permanent or extended them, helping homeowners, buyers, and investors. It’s been praised by groups like the National Association of REALTORS® and the Mortgage Bankers Association.

Key Provisions You Should Know:

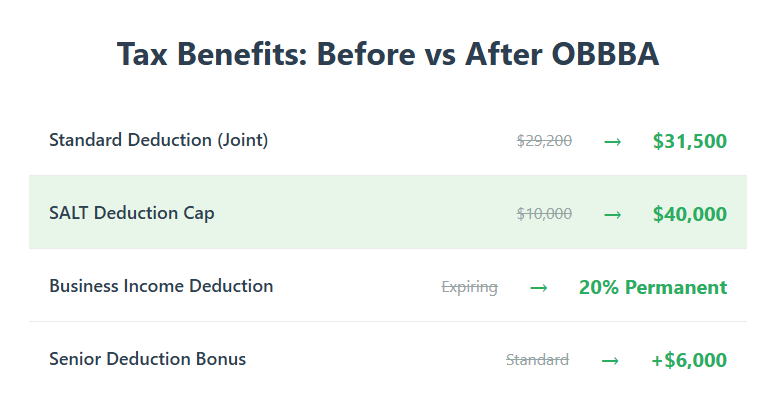

1. 2017 Tax Cuts Stay (and More Standard Deduction)

Tax rates that were supposed to expire after 2025 are now here to stay. That includes the 10%, 12%, and 22% brackets. The standard deduction also got a major boost:

-

$15,750 for single filers

-

$31,500 for joint filers

-

Extra $6,000 for seniors through 2028

2. Mortgage Interest Deduction Is Safe

You can still deduct mortgage interest on up to $750,000 in mortgage debt. That’s especially helpful for buyers in high-cost areas like Portland, Seattle, and Boise.

3. SALT Deduction Quadrupled (Temporarily)

The deduction for state and local taxes just went from $10,000 to $40,000 — but only for 5 years. If you own a home in a higher-tax area (like Multnomah or King County), this can make a noticeable difference on your tax return.

4. 1031 Exchanges Protected

If you’re investing in real estate, this is a big deal. You can still defer capital gains taxes when you sell a property and buy another of equal or greater value within a short timeframe.

5. More Support for Affordable Housing

The Low-Income Housing Tax Credit was expanded, encouraging more investment in affordable housing — something our region continues to need.

6. Business Income Deduction Made Permanent

If you’re a real estate agent, self-employed, or a small business owner, you can keep deducting up to 20% of your qualified business income. This deduction was set to expire but is now permanent.

7. New ‘Trump Accounts’ for Down Payments

Starting in 2025, every child born through 2028 will get a $1,000 tax-deferred savings account. Parents can add up to $5,000 a year tax-free. These accounts can be used for college — or even a future down payment on a home.

🚨 A New Proposal to Watch: No Tax on Home Sales Act

While not part of the OBBBA, another bill in Congress — the No Tax on Home Sales Act (H.R. 4327) — could eliminate capital gains taxes on the sale of your primary residence. That could save homeowners tens of thousands of dollars and potentially increase housing inventory as more people consider selling.

Final Thoughts

The OBBBA brings major benefits for homeowners and buyers here in the Northwest. If you’re thinking about buying, refinancing, or investing, now’s a great time to review your options — especially with these tax changes in play.

Have questions or want to see what this means for your personal scenario? I’m happy to run the numbers.

Let’s talk.