The Portland-Hillsboro-Vancouver Housing Market Is Turning a Corner Going Into 2026 After several years of…

Portland Housing Market Update: What the January 2026 Data Is Telling Us

Portland Housing Market Update: What the January 2026 Data Is Telling Us

By Matt Jolivette, Mortgage Broker | Associated Mortgage Brokers | NMLS# 90661 Published: February 2026 | Portland-Vancouver-Hillsboro, OR-WA Metro Area

If you have been watching the Portland housing market, the January 2026 numbers are worth paying attention to. The national headlines say home sales dropped. Here in the Portland metro, the numbers tell a more detailed story — one that actually opens a real window of opportunity for buyers who are ready to move.

Let’s break down what the data shows, what is driving it, and what it means if you are buying or selling a home in the Portland-Vancouver-Hillsboro metro area in 2026.

Portland Home Sales Dropped Nearly 3x Faster Than the National Average

The National Association of Realtors (NAR) reported that existing home sales fell 8.4% in January 2026 compared to December 2025. Year-over-year, national sales were down 4.4%. Those numbers are already disappointing — NAR’s own chief economist called it “a new housing crisis.”

But the Portland metro saw a steeper drop.

According to Reventure data for the Portland-Vancouver-Hillsboro MSA:

- January 2026 closed sales: 1,513

- January 2025 closed sales: 1,718

- Year-over-year decline: -11.9%

That is nearly three times the national rate of decline. For context, the West region as a whole saw the largest drop of any U.S. region — and Portland is underperforming even that.

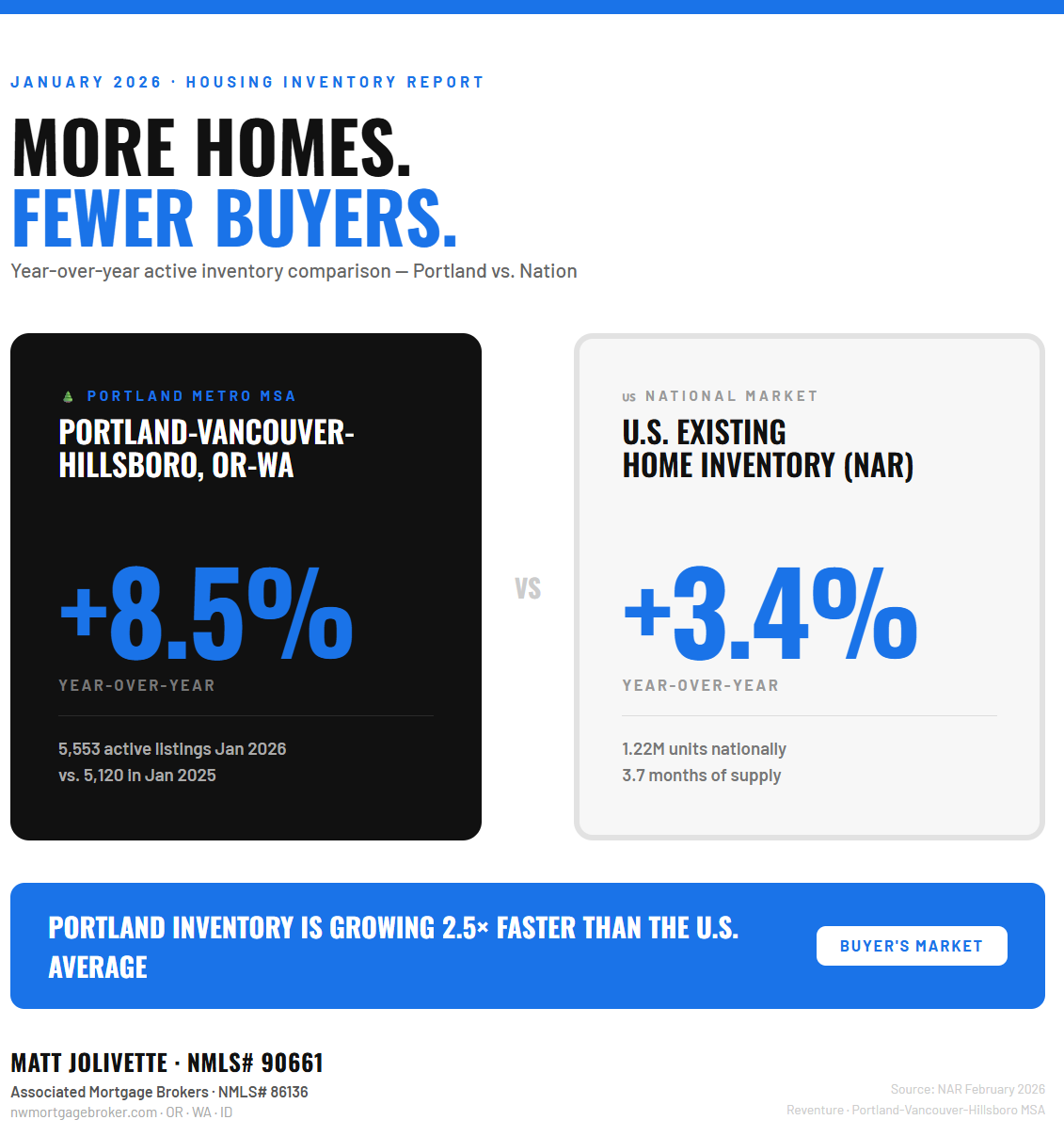

Inventory Is Building Up Faster Here Too

On the supply side, Portland is also running hotter than the national average — but in the opposite direction.

Nationally, active inventory rose 3.4% year-over-year as of January 2026. In the Portland metro:

- January 2026 active listings: 5,553

- January 2025 active listings: 5,120

- Year-over-year increase: +8.5%

That is 2.5 times the national rate of inventory growth. To put it plainly: more homes are sitting on the market, and fewer buyers are closing on them.

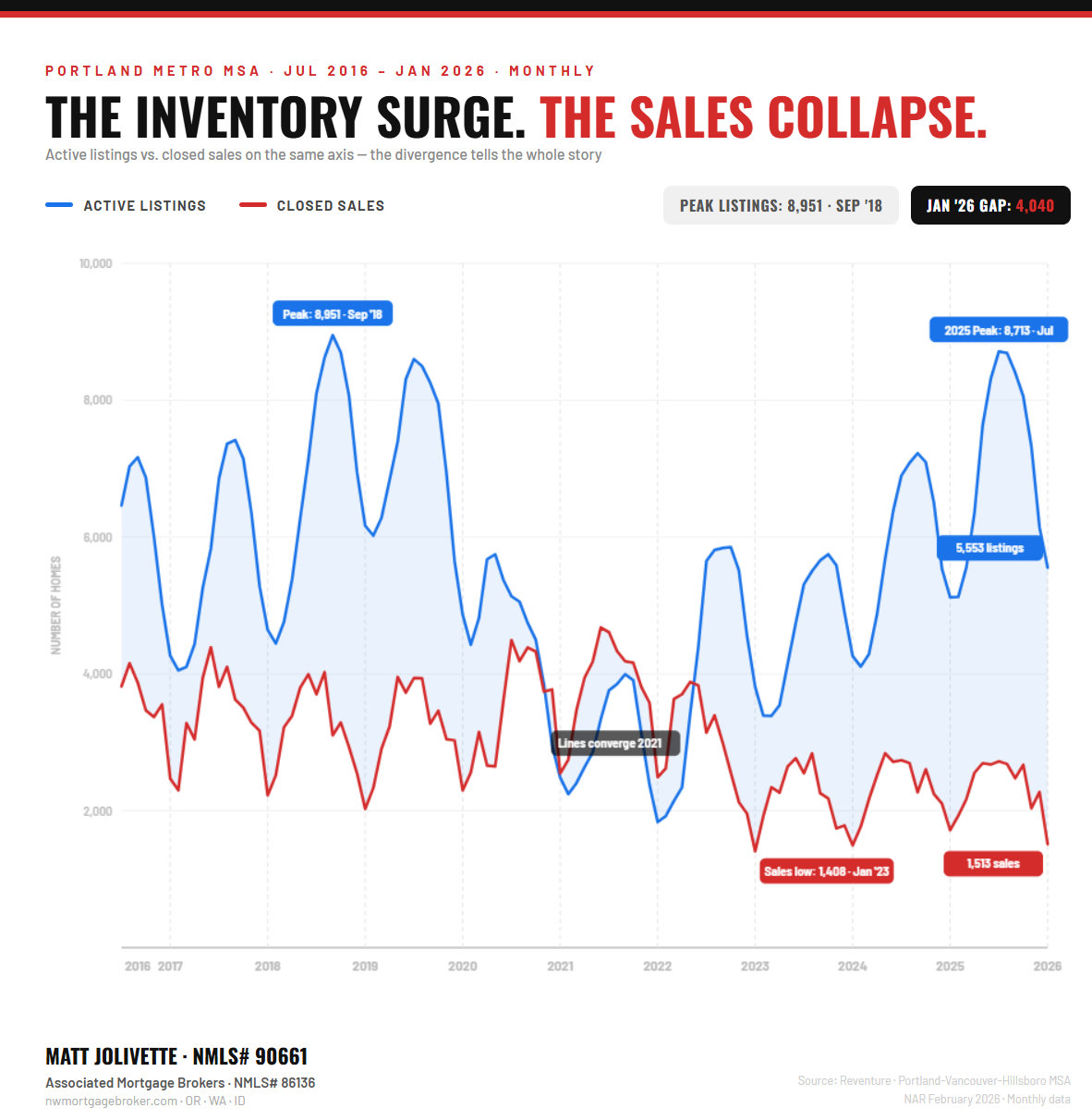

The gap between active listings and closed sales in January 2026 was 4,040 homes. That is a significant spread, and it tells you something important about where the leverage sits in today’s market.

Why Is Portland Underperforming the National Market?

There is no single answer, but a few factors are worth understanding.

Affordability and rate sensitivity. The Portland metro has seen strong home price appreciation over the past decade. Even with mortgage rates dropping nearly a full percentage point compared to a year ago, monthly payments are still a stretch for many buyers — especially first-time buyers without existing equity.

Population and migration trends. The Portland area has experienced net domestic outmigration in recent years. Some of that is people moving to more affordable markets. Some of it reflects remote work flexibility giving people more options. Whatever the reason, fewer net new households means less housing demand pressure.

Cost of living factors. Oregon has a high combined income tax burden, and Portland-specific taxes have added to the load for higher-earning households. When those households leave or reduce their footprint here, it tends to show up in demand data over time.

A market still finding its floor. Closed sales hit a recent low of 1,408 in January 2023. The market has been slowly rebuilding since, but it has not returned to pre-2022 levels. The inventory surge of 2024 and 2025 — where active listings climbed from around 4,200 in early 2024 to a peak of 8,713 in July 2025 — created more supply than demand could absorb.

What This Means for Buyers in the Portland Metro

Here is the part that does not make the headlines: this data is actually good news if you are a buyer sitting on the sidelines.

More inventory means more choices. With over 5,500 active listings in January, buyers have more options than they have had in years. The bidding war environment of 2021 and 2022 is long gone.

Less competition means more negotiating power. When homes are sitting 46 days on average before selling (up from 41 days a year ago nationally), sellers are more motivated. Price reductions, seller concessions, and rate buydowns are all back on the table.

Rates are lower than a year ago. The average 30-year fixed rate briefly dropped to 6.06% in January — the lowest since September 2022. Even at current levels, buyers are looking at rates nearly a full percentage point lower than January 2025.

Affordability is improving. NAR’s Housing Affordability Index is at its highest point since March 2022. Wages have grown faster than home prices, which is shifting the math in buyers’ favor.

The buyers who move while others wait tend to be the ones who look back glad they did.

What This Means for Sellers

If you are selling in the Portland metro right now, realistic pricing is the name of the game. With 5,553 competing listings and only 1,513 closings in January, overpriced homes are sitting. Homes that are priced right and show well are still moving.

Working with a buyer who has strong financing — including a pre-approval that clearly documents their loan program, rate, and payment — still makes a significant difference in how sellers evaluate offers.

Portland Housing Market Outlook for 2026

The trajectory for 2026 will depend heavily on where mortgage rates go. If rates continue to ease, even modestly, you can expect buyer activity to pick back up heading into spring and summer — which is historically the strongest selling season in the Pacific Northwest.

The inventory question is equally important. Portland has more supply than it has absorbed in recent years. If that inventory starts to get absorbed as buyers return to the market, you could see pricing stabilize or even firm up in certain price ranges and neighborhoods.

The $250,000-and-under segment nationally saw the steepest sales declines. In Portland, that means the entry-level and townhome market faces the most headwinds. Move-up buyers and the $500,000-$800,000 range in established suburbs — think SW Portland, Lake Oswego, West Linn, and the Vancouver/Camas corridor — tend to be more insulated.

Frequently Asked Questions: Portland Housing Market 2026

Is it a buyer’s market in Portland right now? Yes. With inventory up 8.5% year-over-year and closed sales down 11.9%, the Portland-Vancouver-Hillsboro metro is currently favoring buyers. There are more homes to choose from and less competition than there has been in several years.

Are home prices dropping in Portland in 2026? Nationally, the median home price rose 0.9% year-over-year to $396,800 in January 2026. Portland-specific price data varies by neighborhood and price tier. Generally, sellers who overprice are seeing extended days on market, while correctly priced homes are still selling.

What are mortgage rates in Portland right now? Mortgage rates are determined by national market conditions, not local ones. As of early 2026, the 30-year fixed rate is hovering near 6%, which is close to a full percentage point lower than January 2025. Contact a licensed mortgage broker for a personalized rate quote based on your credit, down payment, and loan program.

Why are home sales falling in Portland? Several factors are contributing: affordability challenges from years of price appreciation, net domestic outmigration, a high cost-of-living environment, and the broader national slowdown in existing home sales. The rate lock-in effect — where homeowners with 3% mortgages are reluctant to sell and take on a new loan at 6% — has also constrained the number of listings coming to market from existing homeowners.

Is now a good time to buy a home in Portland? For buyers who are financially ready and planning to stay in the area for several years, the current conditions — more inventory, less competition, and lower rates than a year ago — represent a genuine opportunity. The “perfect time” to buy is rarely obvious in the moment. A licensed mortgage broker can help you evaluate your specific situation.

How does Portland compare to the national housing market? Portland’s home sales are declining faster than the national average (-11.9% vs. -4.4% year-over-year) and inventory is growing faster (+8.5% vs. +3.4%). This means Portland buyers have more relative leverage than buyers in most U.S. markets right now.

Talk to a Portland Mortgage Broker

Matt Jolivette has been helping buyers and homeowners navigate the Oregon and Washington mortgage market for over 26 years — through the dot-com crash, the 2008 housing crisis, the pandemic boom, and today’s shifting market.

If you are thinking about buying, refinancing, or just want to understand what you qualify for in today’s market, reach out for a no-pressure conversation.

Matt Jolivette | NMLS# 90661

Associated Mortgage Brokers | NMLS# 86136

nwmortgagebroker.com

Serving: Oregon · Washington · Idaho