As we approach the final month of 2025, the Portland housing market is presenting a…

Why Experts Say Mortgage Rates Could Ease — and What That Means for the Portland–Vancouver Region

Why Experts Say Mortgage Rates Could Ease — and What That Means for the Portland–Vancouver Region

You’re watching mortgage rates closely — and you probably want them to go down. In many ways, the national forces pushing rates are also relevant locally here in the Portland–Hillsboro–Vancouver metro area. But what does it mean for you in Beaverton, Gresham, Clark County, or the Oregon/Washington border zones? Let’s dig in.

How Mortgage Rates and the 10‑Year Treasury Yield Are Linked — Even Here

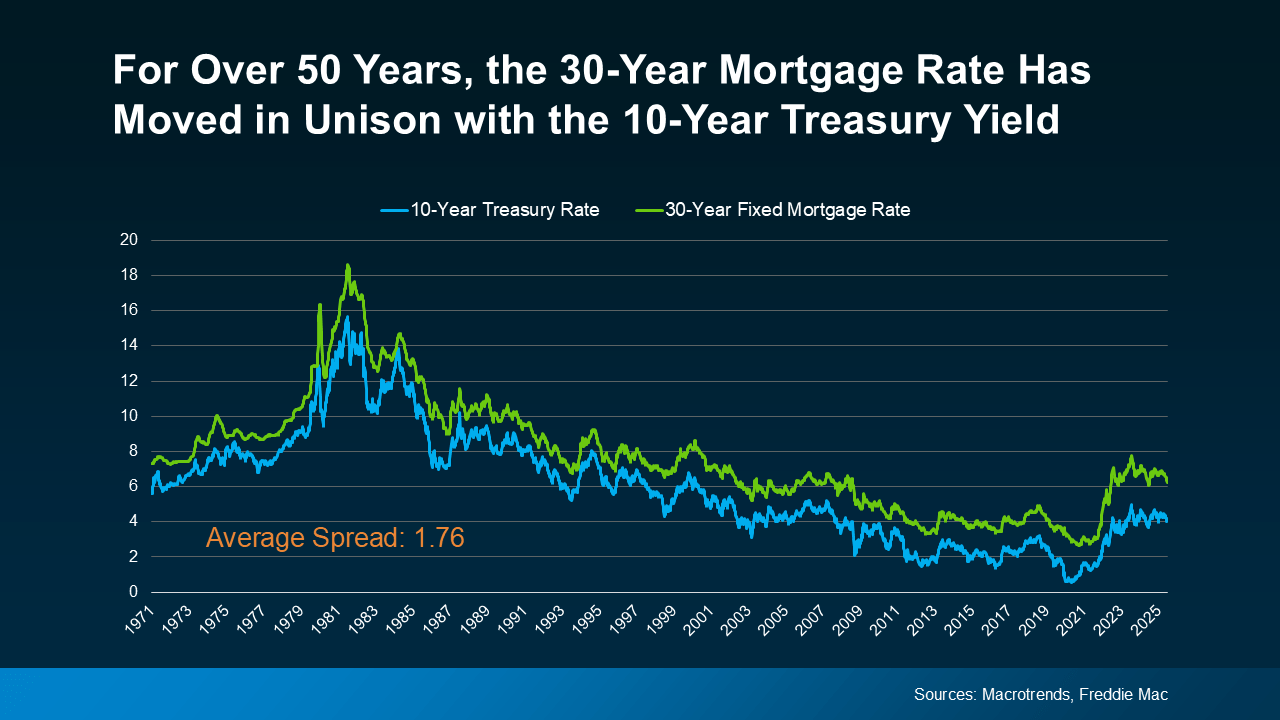

Nationally, the 30‑year fixed mortgage rate tends to follow the 10‑year U.S. Treasury yield. When that yield drops, mortgage rates often follow (and vice versa).

One key component is the “spread” — the margin that lenders charge above the 10‑year yield to cover risk, investor demand, and other factors. Over long stretches, that spread averages around 1.7 to 1.8 percentage points. But in uncertain times, it widens. Right now, as markets feel less volatile, some of that spread is compressing, which helps push mortgage rates downward.

So the two levers to watch are:

-

Where the 10‑year Treasury yield heads

-

Whether the mortgage-to-Treasury spread tightens

When both move favorably, rates tend to ease.

National Forecasts + Local Conditions = Opportunity

Nationally, many economists expect mortgage rates to drift lower over the next year — not collapsing back to pandemic lows, but possibly easing from the mid/upper 6% range toward high 5’s or low 6’s if inflation softens and the Fed signals rate cuts.

Source: Forbes

Here in the Portland–Vancouver–Hillsboro area, we already see some relevant local dynamics:

-

The median home value across the Portland–Vancouver–Hillsboro MSA is around $545,000, slipping about 0.7% year over year.

-

In Vancouver, WA, the average home value is about $503,275, down roughly 1.0% in the last 12 months.

-

In Portland, homes are receiving an average of 3 offers and selling in about 32 days, with a median sale price of $530,000.

-

Listings in Portland are staying on market longer — 41% of homes in April 2025 sat for 60+ days without a sale.

-

Inventory has been rising in the region, giving buyers more options and stronger negotiating leverage.

What Rate Easing Might Look Like for Your Buyers and Sellers

If the 10‑year yield drops and spreads tighten, we could see 30‑year fixed mortgage rates in this region drift into the upper 5% to low 6% range by late 2025 or 2026 — depending on inflation, employment, and Fed policy.

Here’s how that could play out locally:

-

Buyers in Beaverton, Vancouver, or Hillsboro may find their qualifying power increases with even a modest rate drop.

-

Refinancers could begin to act more aggressively as monthly savings improve.

-

Sellers who’ve been waiting on the sidelines may reenter the market once more buyers become eligible.

-

Negotiation leverage is shifting toward buyers, especially on stale listings or homes with price reductions.

-

Because I’m licensed in Oregon, Washington, and Idaho, I can help you explore multi-state options for financing, taxes, and property selection.

Local Callouts & Tips You Can Use

-

In Clark County, WA, buyers benefit from no state income tax, but should also factor in higher property taxes vs. Oregon. This can affect monthly payments and affordability profiles.

-

In Portland (Multnomah, Clackamas counties), affordability remains tight. Even a 0.5% drop in rates can open more neighborhoods to first-time or move-up buyers.

-

In Hillsboro / Washington County, tech growth continues to influence housing demand. Rate relief can help buyers stretch into newer developments near Intel and other employers.

-

Use ZIP code-level comps instead of city-wide averages when helping clients gauge value and timing.

-

Always frame rate movement in monthly payment terms. A 0.5% drop could reduce a $500,000 loan’s payment by $150–$175/month, depending on loan type and term.

Bottom Line

National trends suggest mortgage rates could ease in the year ahead. Here in the Portland–Hillsboro–Vancouver metro area, we’re already seeing inventory climb, homes stay on market longer, and buyer power begin to shift.

If the 10‑year yield falls and spreads tighten, we could see rates drop toward the upper 5’s. That creates real opportunities for buyers, sellers, and refinancers — especially across the Oregon–Washington–Idaho corridor where I’m licensed to help you navigate the full market.

Want to talk strategy or run numbers based on your ZIP code or price range? Let’s connect.