As we turn the page on 2025, the housing market in the Pacific Northwest is…

Thinking About Renting Your Pacific NW House Instead of Selling? Read This First.

Thinking About Renting Your Pacific NW House Instead of Selling? Read This First.

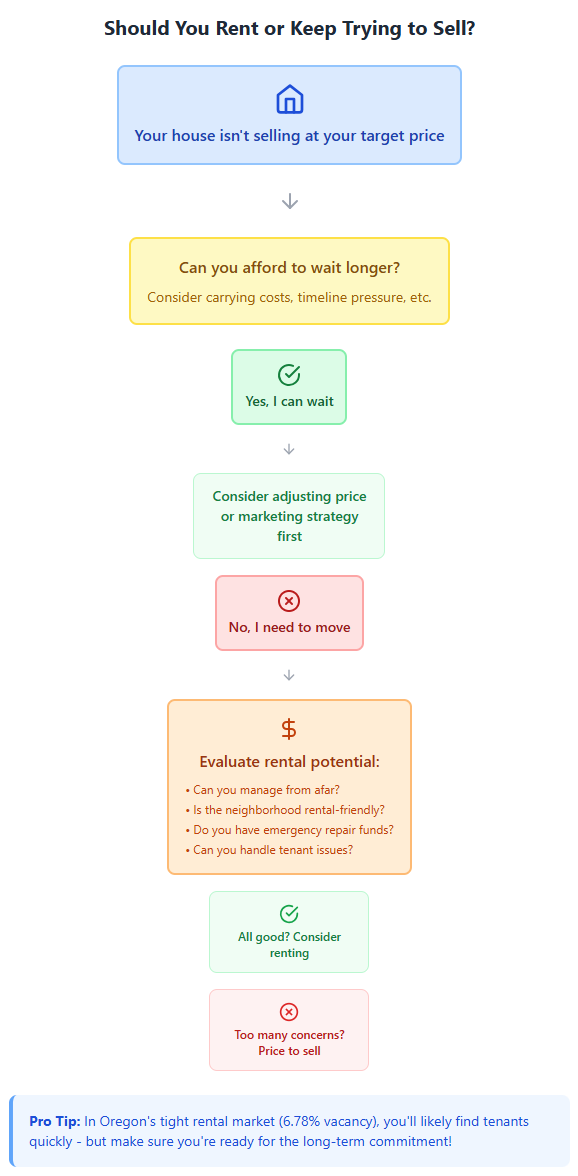

If your house is on the market but you haven’t gotten any offers you’re comfortable with, you may be wondering: what do I do if it doesn’t sell? And for a growing number of homeowners, that’s turning into a new dilemma: should I just rent it instead?

There’s a term for this in the industry, and it’s called an accidental landlord. Here’s how Yahoo Finance defines it:

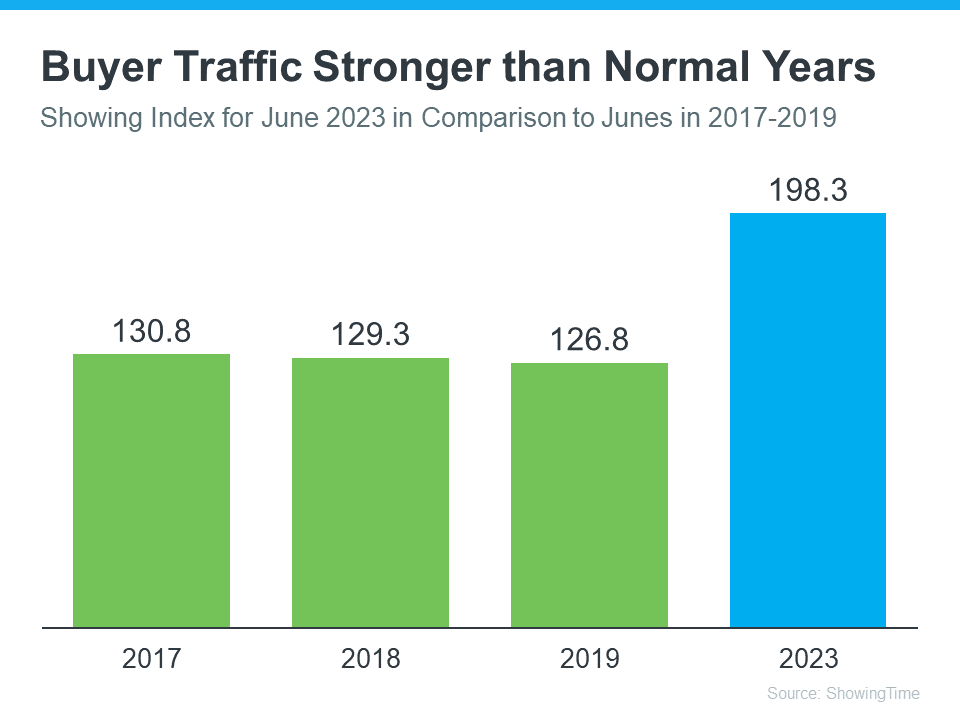

Why This Is Happening More Often Right Now

And right now, the number of homeowners turning into accidental landlords is rising. Business Insider explains why:

Basically, sales have slowed down as buyers struggle with today’s affordability challenges. And that’s leaving some homeowners with listings that sit and go stale. And if they don’t want to drop their price to try to appeal to buyers, they may rent instead.

But here’s the thing you need to remember if renting your house has crossed your mind. Becoming a landlord wasn’t your original plan, and there’s probably a reason for that. It comes with a lot more responsibility (and risk) than most people expect.

So, if you find yourself toying with that option, ask yourself these questions first:

1. Does Your House Have Potential as a Profitable Rental?

Just because you can rent it doesn’t mean you should. For example:

- Are you moving out of state? Managing maintenance from far away isn’t easy.

- Does the home need repairs before it’s rental-ready? And do you have the time or the funds for that?

- Is your neighborhood one that typically attracts renters, and would your house be profitable as one?

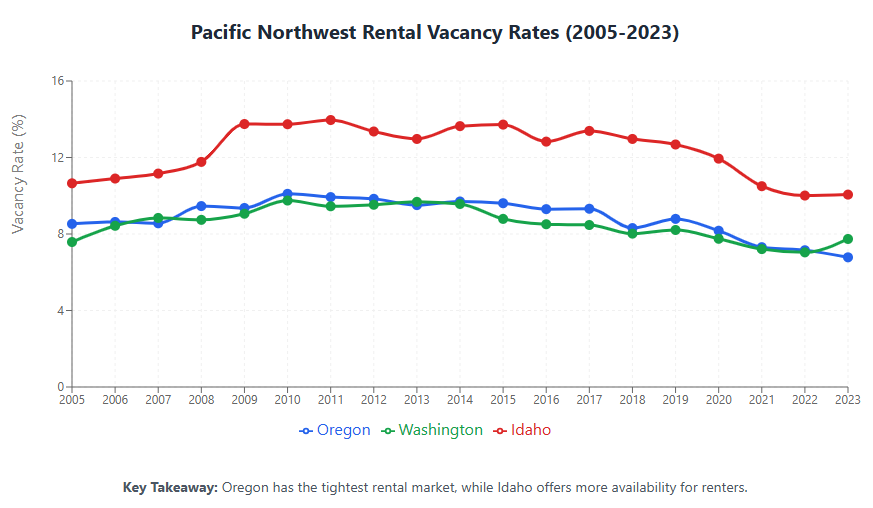

Here’s what the rental market looks like in the Pacific Northwest right now:

In Oregon, vacancy rates have dropped to just 6.78% as of 2023 – the lowest they’ve been since 2005. Washington sits at 7.74% vacancy, while Idaho has a higher vacancy rate at 10.06%. Lower vacancy rates mean more competition among renters, which could work in your favor if you decide to rent. But it also means tenant turnover might be less frequent, so you need to be ready for longer-term commitments.

If any of those give you pause, it’s a sign selling might be the better move.

2. Are You Ready To Be a Landlord?

On paper, renting sounds like easy passive income. In reality, it often looks more like this:

- Midnight calls about clogged toilets or broken air conditioners

- Chasing down missed rent payments

- Damage you’ll have to fix between tenants

As Redfin notes:

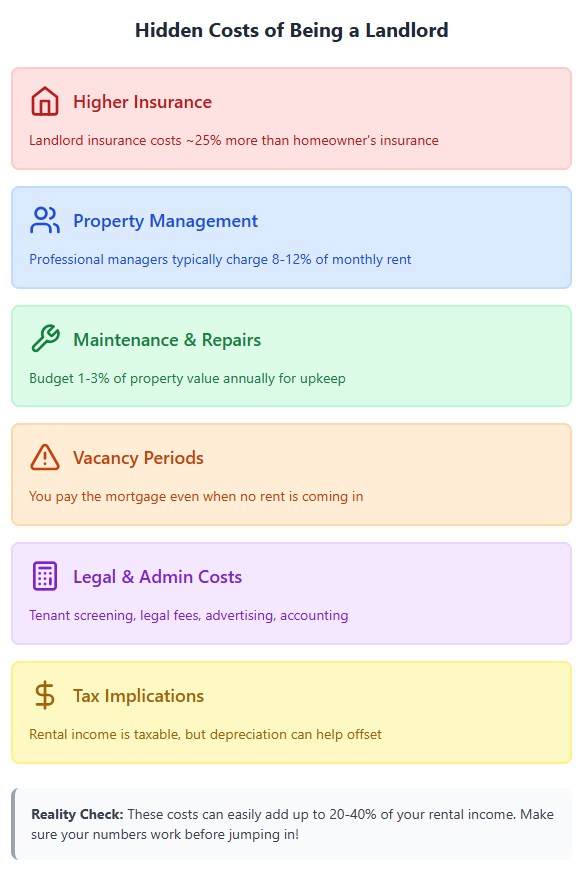

3. Have You Thought Through the True Costs?

According to Bankrate, here are just a few of the hidden costs that come with renting out your home:

All of that adds up, fast.

Pacific Northwest Reality Check: With Oregon’s low 6.78% vacancy rate, you might have less downtime between tenants compared to Idaho’s 10.06% rate. But Washington and Oregon also have some of the strictest tenant protection laws in the country, which can make evictions more costly and time-consuming if problems arise.

While renting can be a smart move for the right person with the right house, if you’re only considering it because your listing didn’t get traction, there may be a better solution: talking to your current agent and revisiting the pricing strategy on your house first.

With their advice you can rework your strategy, relaunch at the right price, and attract real buyers to make the sale happen.

Bottom Line

Before you decide to rent your house, make sure to carefully weigh the pros and cons of becoming a landlord. For some homeowners, the hassle (and the expense) may not be worth it. In the Pacific Northwest’s tight rental market, you might find tenants quickly – but you’ll also need to navigate complex landlord-tenant laws and be prepared for the long-term commitment that comes with property management.