Why "Help with Mortgage" Searches Are Surging in the Pacific Northwest - What This Means…

Mortgage Rates Are Stabilizing – What That Means for Portland Buyers 🏡

Mortgage Rates Are Stabilizing – What That Means for Portland Buyers 🏡

5 min read

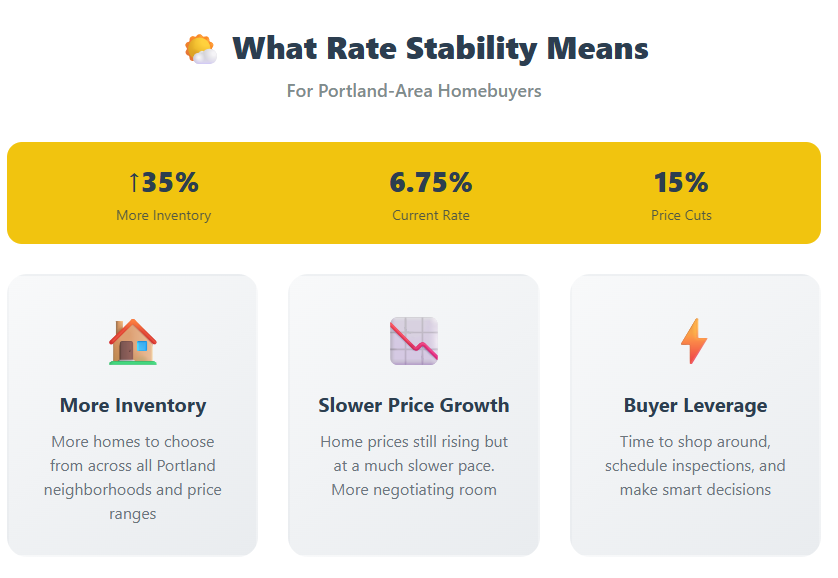

🌤️ Mortgage Rate Stability Brings New Confidence to Portland Buyers

Affordability has been a major hurdle for Portland-area homebuyers in recent years. Rapidly rising home prices, paired with elevated mortgage rates, left many feeling like homeownership was just out of reach. But there’s good news on the horizon: mortgage rates have recently stabilized, offering a more predictable environment for planning a move.

Currently, rates have been holding steady in the mid to high 6% range, staying within a relatively narrow band for several months. This consistent trend marks one of the calmest periods for mortgage rates in recent memory.

📍 What This Means for the Portland Housing Market

🔹 More Inventory, Less Pressure

In Portland and the surrounding metro, inventory levels have risen noticeably this year, giving buyers more choices than they’ve had in quite some time. From the vibrant Alberta Arts District to family-friendly Beaverton and Hillsboro, buyers are finding more active listings across price points.

🔹 Slower Price Growth

While home prices are still climbing slightly, the pace has slowed. More sellers are adjusting their expectations and pricing homes more competitively. Many listings are seeing price reductions, which creates room for negotiation and can help offset some of the cost of today’s rates.

🔹 Buyer Leverage Returns

With more homes on the market and listings spending longer days before selling, Portland buyers are regaining some of the leverage they lost during the frenzied seller’s market of the past few years. There’s now more time to shop around, schedule inspections, and make informed decisions without rushing.

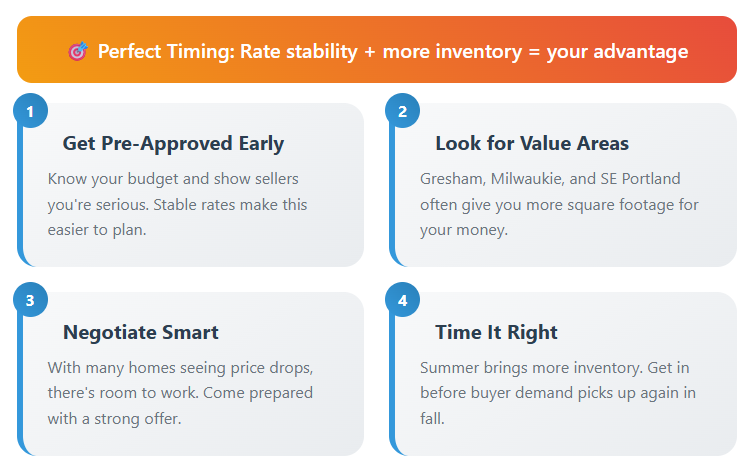

📈 Planning Your Move with Confidence

One of the biggest challenges in past market cycles was uncertainty—rates rising sharply from one week to the next made it difficult to budget or plan. Now that rates are stable, it’s easier to forecast monthly payments and determine what fits your financial goals. This clarity helps reduce the stress of timing your purchase.

Even though rates aren’t back to their historic lows, today’s environment is far less volatile. That’s a powerful shift for buyers who are tired of waiting on the sidelines.

🔮 What’s Ahead for Rates?

Experts expect a slow and steady downward trend in rates over the coming months, though any change is likely to be gradual. If you’re holding out for a perfect drop in rates, you may find that what’s available now is already close to the best window you’ll get in the near future.

💡 Pro Tips for Portland-Area Buyers

🏁 Bottom Line

While affordability is still a challenge, rate stability and improved inventory are making the Portland housing market more navigable for buyers. If you’ve been waiting for the right moment, this could be it.

Let’s connect and run the numbers together. Whether you’re looking in inner Portland, the Westside suburbs, or across the Columbia in Vancouver, now’s a great time to start planning your next move.