Trade Wars and Mortgage Rates: What Portland, Oregon Homebuyers Need to Know in 2025 With…

Understanding the Impact of Lower Mortgage Rates on Your Home Buying Power in the Pacific Northwest

What Lower Mortgage Rates Mean for Your Purchasing Power

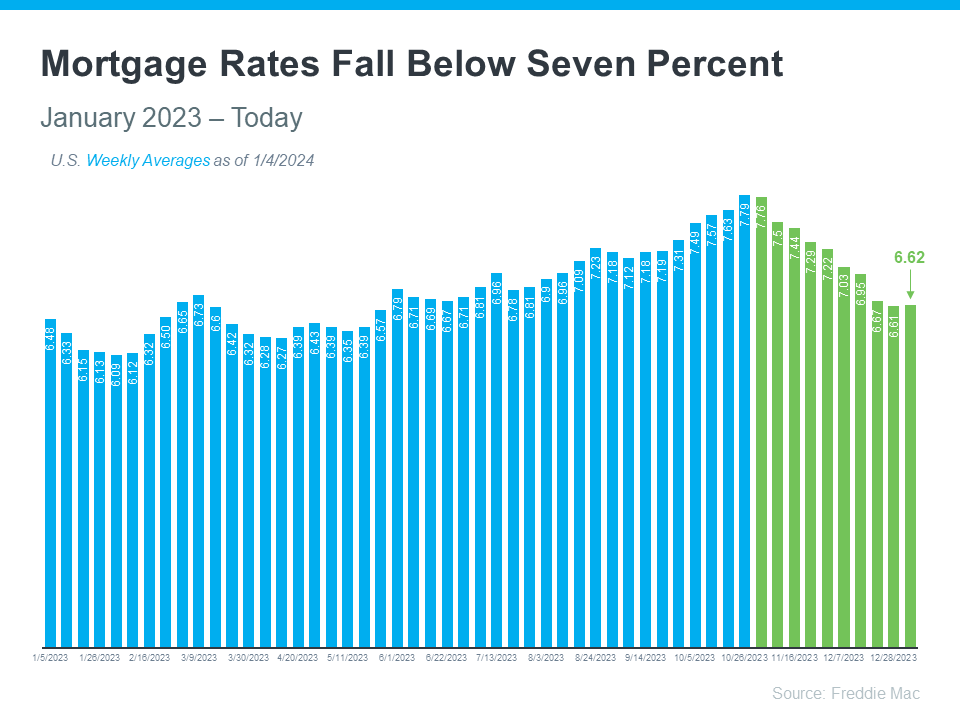

When you’re in the market for a home in the Portland metro area or the broader regions of Oregon, Washington, and Idaho, comprehending the influence of mortgage rates on your purchasing capabilities is key. Recent trends show a promising shift: 30-year fixed mortgage rates have dipped below 7% since late October, as per Freddie Mac. This decrease offers a significant advantage for buyers in our local markets.

This recent trend is great news for buyers. As a recent article from Bankrate says:

“The rate cool-off somewhat eases the housing affordability squeeze.”

And according to Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association (MBA):

“MBA expects that affordability conditions will continue to improve as mortgage rates decline . . .”

Here’s a bit more context on how this could help with your plans to buy a home.

How Mortgage Rates Shape Your Home Search in Oregon, Washington and Idaho

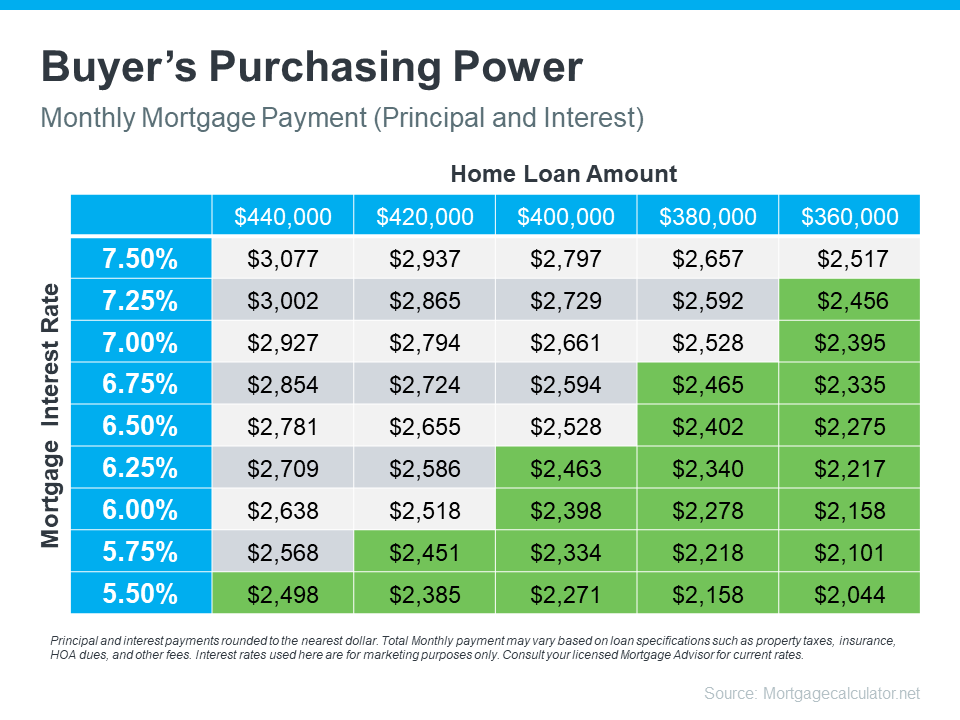

Understanding mortgage rates’ role in determining your monthly home payments is vital for prospective homeowners. For instance, if your budget is set for a monthly payment between $2,400 and $2,500, a slight rate fluctuation can significantly alter the loan amount you’re eligible for(see chart below):

As you can see, even small changes in rates can affect your budget and the loan amount you can afford.

Get Help from Reliable Experts To Understand Your Budget and Plan Ahead

When you’re looking to buy a home, it’s important to get guidance from a local real estate agent and a trusted lender. They can help you explore different mortgage options, understand what makes mortgage rates go up or down, and how those changes impact you.

By looking at the numbers and the latest data together, then adjusting your strategy based on today’s rates, you’ll be better prepared and ready to buy a home.

Bottom Line

For those looking to purchase homes in Oregon, Washington, or Idaho, the recent downtrend in mortgage rates is a positive sign. It’s essential to connect with local experts who can guide your home-buying journey in these distinctive markets. Let’s collaborate to craft your personalized plan for homeownership in this exciting region.