Trade Wars and Mortgage Rates: What Portland, Oregon Homebuyers Need to Know in 2025 With…

Navigating Mortgage Rate Fluctuations in the Portland-Vancouver Metro Area: Insights for 2024

What’s Really Happening with Mortgage Rates?

Are you navigating the mortgage rate maze in the Portland, OR, and Vancouver, WA metro areas? That might be because you’ve heard someone say they’re coming down. But then you read somewhere else that they’re up again. And that may leave you scratching your head and wondering what’s true.

The simplest answer is: that what you read or hear will vary based on the time frame they’re looking at. Here’s some information that can help clear up the confusion.

Mortgage Rates Are Volatile by Nature

Mortgage rates don’t move in a straight line. There are too many factors at play for that to happen. Instead, rates bounce around because they’re impacted by things like economic conditions, decisions from the Federal Reserve, and so much more. That means they might be up one day and down the next depending on what’s going on in the economy and the world as a whole.

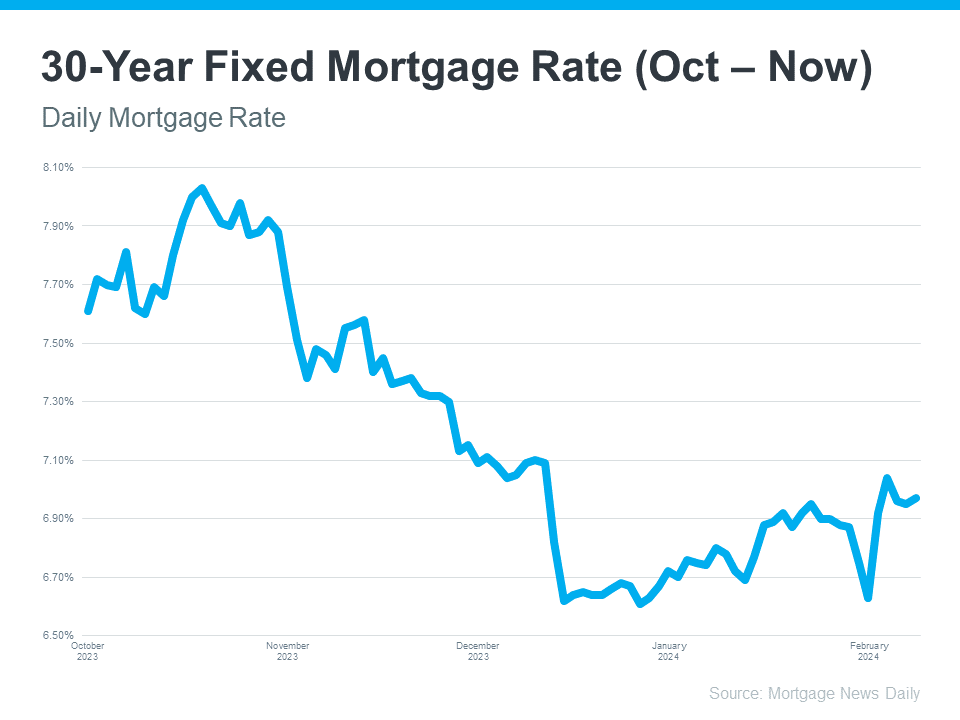

Take a look at the graph below. It uses data from Mortgage News Daily to show the ebbs and flows in the 30-year fixed mortgage rate since last October:

If you look at the graph, you’ll see a lot of peaks and valleys – some bigger than others. And when you use data like this to explain what’s happening, the story can be different based on which two points in the graph you’re comparing.

For example, if you’re only looking at the beginning of this month through now, you may think mortgage rates are on the way back up. But, if you look at the latest data point and compare it to the peak in October, rates have trended down. So, what’s the right way to look at it?

Mortgage Rates: A Local Perspective

Examining data specific to our region (ensure you include or reference local data here), we see the 30-year fixed mortgage rate has experienced its fair share of ups and downs since last October, mirroring national trends but also reflecting local economic influences.

Interpreting Local Trends

When looking at recent data, it’s crucial to consider both short-term movements and long-term trends. A month-to-month comparison might show an uptick in rates, but a broader view from last year to now reveals a more nuanced picture, potentially indicating a favorable trend for buyers in the Portland-Vancouver metro area.

The Big Picture

Mortgage rates are always going to bounce around. It’s just how they work. So, you shouldn’t focus too much on the small, daily changes. Instead, to really understand the overall trend, zoom out and look at the big picture.

When you look at the highest point (October) compared to where rates are now, you can see they’ve come down compared to last year. And if you’re looking to buy a home, this is big news. Don’t let the little blips distract you. The experts agree, overall, that the larger downward trend could continue this year.

Bottom Line

The Portland-Vancouver housing market, with its unique dynamics, requires a keen eye on both local and national trends to navigate successfully. If you’re considering buying a home in this vibrant region, staying informed about mortgage rates—beyond the temporary fluctuations—can provide a strategic advantage. For personalized advice and insights, connecting with a local mortgage expert can demystify the process and help you move forward with confidence.