Portland Housing Market Forecast 2025: What to Expect for the Rest of the Year Wondering…

Understanding Foreclosure Activity in the Northwest: A Closer Look at Oregon, Washington, and Idaho

Foreclosure Activity Is Still Lower than the Norm

Recent headlines have spotlighted an uptick in foreclosure rates across the housing market, generating unease among homeowners and buyers in the Portland, OR/Vancouver, WA metro area, and beyond into Oregon, Washington, and Idaho. Yet, it’s crucial to delve beyond these clickbait titles to grasp the full scope of the situation.

The truth is, if you compare the current numbers with what usually happens in the market, you’ll see there’s no need to worry.

Putting the Headlines into Perspective

The increase the media is calling attention to is misleading. That’s because they’re only comparing the most recent numbers to a time where foreclosures were at historic lows. And that’s making it sound like a bigger deal than it is.

In 2020 and 2021, the moratorium and forbearance program helped millions of homeowners stay in their homes, allowing them to get back on their feet during a very challenging period.

When the moratorium came to an end, there was an expected rise in foreclosures. But just because foreclosures are up doesn’t mean the housing market is in trouble.

Historical Data Shows There Isn’t a Wave of Foreclosures

Instead of comparing today’s numbers with the last few abnormal years, it’s better to compare to long-term trends – specifically to the housing crash – since that’s what people worry may happen again.

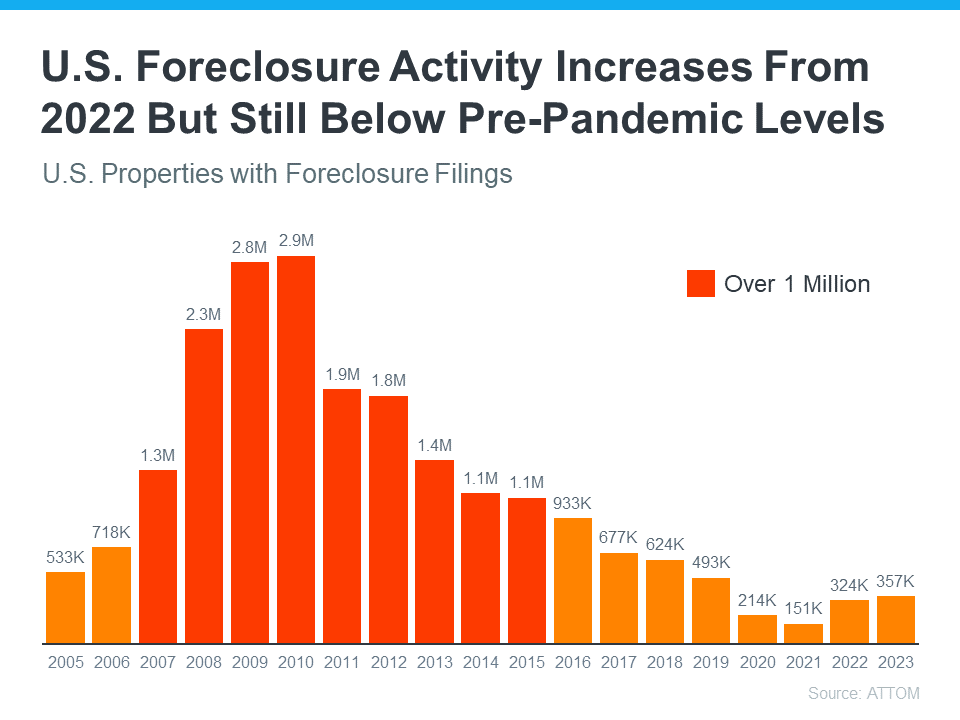

Take a look at the graph below. It uses foreclosure data from ATTOM, a property data provider, to show foreclosure activity has been consistently lower (shown in orange) since the crash in 2008 (shown in red):

So, while foreclosure filings are up in the latest report, it’s clear this is nothing like it was back then.

In fact, we’re not even back at the levels we’d see in more normal years, like 2019. As Rick Sharga, Founder and CEO of the CJ Patrick Company, explains:

“Foreclosure activity is still only at about 60% of pre-pandemic levels. . .”

That’s largely because buyers today are more qualified and less likely to default on their loans. Delinquency rates are still low and most homeowners have enough equity to keep them from going into foreclosure. As Molly Boesel, Principal Economist at CoreLogic, says:

“U.S. mortgage delinquency rates remained healthy in October, with the overall delinquency rate unchanged from a year earlier and the serious delinquency rate remaining at a historic low… borrowers in later stages of delinquencies are finding alternatives to defaulting on their home loans.”

The reality is, while increasing, the data shows a foreclosure crisis is not where the market is today, or where it’s headed.

The Northwest Perspective: Portland, Oregon, Washington, and Idaho

Focusing on the Portland, OR/Vancouver, WA metro area, alongside Oregon, Washington, and Idaho, the foreclosure narrative mirrors the national trend but with local nuances. The region’s housing market has shown remarkable resilience, supported by strong economic fundamentals and a robust demand for housing. Homeowners in these states enjoy substantial equity, further buffering against foreclosure risks.

Bottom Line

The current state of the housing market, particularly in the Northwest, is far from a foreclosure crisis. It’s a market readjusting, slowly moving towards pre-pandemic norms. For those navigating the Portland, OR/Vancouver, WA metro area, and the broader regions of Oregon, Washington, and Idaho, it’s important to consult with a knowledgeable mortgage broker who can provide tailored advice and insights.

If you have questions or concerns about the housing market and foreclosure rates in your area, let’s connect. Together, we can navigate the market with confidence, armed with accurate information and strategic advice.